理查德·沃納:華盛頓式的“發展”打着比較優勢的幌子,就為阻礙發展

【文/觀察者網專欄作者 理查德·沃納】

中國國家主席習近平於2013年提出了“一帶一路”倡議,該倡議在2017年被寫入中國共產黨黨章。這凸顯了“一帶一路”對中國的重要意義,同時明確它是一個長期性的項目。我們知道“一帶一路”倡議對中國很重要,那麼它對世界又有何意義呢?

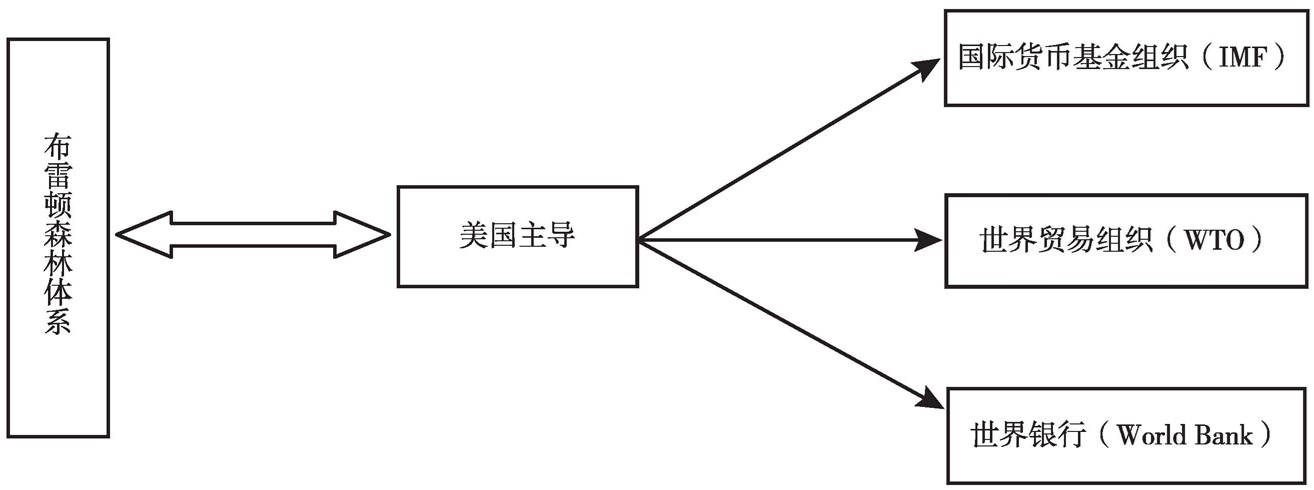

要想理解“一帶一路”倡議的國際意義,就需要先了解二戰後發展中國家的情況。當時構建的佈雷頓森林體系,以及其總部設在華盛頓的下屬機構國際貨幣基金組織和世界銀行,在此期間起到了至關重要的作用。

1942年,以美國和英國為首的26國反法西斯同盟將自己重新命名為“聯合國”。其中的許多國家,主要包括蘇聯、中國、英國及其殖民地以及美國及其殖民地等國,在新罕布什爾州佈雷頓森林的一個高級高爾夫俱樂部度假村舉行會議。在那裏,他們正式制定了戰後以美元為核心的新國際貨幣體系的相關計劃。

這一體系最初要求所有貨幣與美元保持固定匯率,而美元本身可以按規定匯率兑換成黃金。這一體系一直維持到52年前,即1971年8月。1960年代,美國中央銀行和美國銀行大量製造美元,被美國投資者用來收購全球各地的企業、土地和資產,激怒了當地人民。法國開始將自己的美元儲備兑換成黃金,導致美國的黃金儲備下降。隨着法國海軍艦艇不斷前往曼哈頓將黃金運回法國,美國時任總統尼克松在1971年8月15日發表了著名的聲明,宣佈美國將“暫停”美元兑換黃金,等於美國違背了佈雷頓森林固定匯率體系下的義務。

在這次“尼克松衝擊”的一個月前,發生了另一件大事:時任美國總統國家安全事務助理的基辛格成為首個訪問新中國的美國政府高級官員。順便説一句,儘管基辛格已經年過百歲,但半個多世紀後,他又重訪了中國。

基辛格首次訪華時,美國正面臨着貿易赤字膨脹和政府預算赤字激增的雙重問題,後者是由於軍事和情報(包括在數十個國家發動戰爭和政變行動)支出不斷增加造成的,前者是由於成功的貿易淨出口國日本和德國沒有想要購買的美國製造商品。

當美國不再允許按固定匯率用美元兑換黃金時,美元估值下跌了。為了維持軍事霸權,美國領導人認為必須阻止美元下跌,通過德國和日本等國的進口需求找到了解決辦法:後者的大部分能源都需要進口。因此,美元從黃金支持的美元變成了石油支持的美元,即所謂的“石油美元”。

美國在最大的產油國沙特阿拉伯部署了軍隊,並達成了一項協議,即美國將支持沙特阿拉伯政府和王室,後者作為交換條件同意只用美元出售石油,並將沙特阿拉伯由此獲得的美元儲備的80%投資回美國國債,從而為美國政府提供應對預算赤字的資金,變相為美國的海外戰爭提供資金。

2021年,在敍利亞油田的美軍。(圖源:AFP)

德國和日本需要持有美元,以購買經濟運行所需的能源。當然,他們也探索了一些替代方案,比如德國逐漸開始從蘇聯進口天然氣,因為蘇聯的天然氣供應一直很可靠。

支撐美元的另一個步驟是策劃石油價格的大幅上漲,這實質上是將大量資源從製造業強國德國和日本轉移到沙特阿拉伯和美國。為此,基辛格不得不與沙特人周旋,迫使他們將石油價格抬高四倍,這在1974年1月得以實現。

為了轉移人們的視線,並散佈油價上漲是因為歐佩克石油禁運的説法,美聯儲勢力範圍內的中央銀行,包括英格蘭央行、日本央行和德國央行,在1971年和1972年同時開始大規模擴大貨幣供應,鼓勵銀行信貸的瘋狂擴張,用於房地產投機和消費。

這導致了1970年代的通貨膨脹,儘管官方的主流説法是通貨膨脹是戰爭及其隨後的能源禁運造成的。正如基辛格時隔50年再度訪華一樣,半個世紀後,西方再次試圖將最近的通脹甩鍋給所謂的“俄羅斯保衞烏克蘭邊境新成立共和國的軍事行動”,而這實際上是美聯儲、英格蘭央行和歐洲央行共同在2020年3月大規模擴張銀行信貸的後果。因此,美國的經濟和政治霸權在1970年代得以延續。

與此同時,國際貨幣基金組織和世界銀行等佈雷頓森林機構,被用來管理全球許多國家和人民的去殖民化和獨立運動:英國、美國、法國、比利時和荷蘭等海外殖民帝國面臨着越來越多的當地人要求政治獨立的壓力。既然這些國家曾在第二次世界大戰期間辯稱自己是為了自由和民主而與德國鬥爭,他們現在很難再拖延在其直接控制下的發展中國家大多數人口的“去殖民化”進程。

非洲去殖民化進程

西方現代“發展經濟學”教科書告訴我們,正是這一“去殖民化”進程創造了這門新的學科。這些教科書指出,這門學科在上世紀中葉之前並不存在,之所以創立這門學科,是因為越來越多的前殖民地開始獨立。

但是,發展經濟學並不是由這些新獨立國家的主要思想家創立的!相反,它是由英國和美國的經濟學家創立的。這就揭示了“發展經濟學”的真正目的:倘若殖民國家主流經濟學家開設這門英文學科的目的是幫助各國和各地區快速發展,從發展中國家地位邁向發達國家行列,那麼這門學科的歷史本應與殖民主義一同誕生;對於殖民國家的思想家來説,最合適於塑造一個國家並落實正確政策的時機,顯然是當該國直接受殖民者控制之時。

然而,在幾個世紀的殖民統治期間,西方並沒有認為需要這樣的“發展經濟學”,只有當殖民者不得不放棄對其殖民地的正式政治和軍事控制時,他們才會想到這些前殖民地臣民需要考慮如何發展經濟。那麼,這些前殖民地憑什麼要相信在全面殖民主義時代沒有發展自己經濟的前殖民主子呢?他們真的應該直接接納殖民主子臨別時遞給他們的關於如何發展經濟的書籍嗎?

為了防止前殖民地臣民對“高尚”和“善良”的前殖民主子的建議產生牴觸情緒,總部設在華盛頓的國際貨幣基金組織和世界銀行機構利用金錢的力量,使“發展經濟學”的新規則更具説服力,他們在發放貸款時包含了著名的“附加條件”。

其他組織,包括美洲開發銀行等地區性開發銀行、美國國際開發署、經濟合作與發展組織(OECD)以及日益具有影響力的歐盟官僚機構,也都在重複和強化華盛頓共識的“發展經濟學”。這些華盛頓機構和美國勢力範圍內的許多其他組織(包括歐洲大部分地區)都在宣揚英語“發展經濟學”的觀點,即各國需要放松管制、實行自由化和私有化,並向外國競爭者開放市場,允許外國投資進入。

他們宣揚的主要觀點是,經濟增長和發展需要大量的金融“儲蓄”,如果國家儲蓄率低,就可以用國際銀行(如國際貨幣基金組織和世界銀行本身)借給它們的錢作為“外國儲蓄”。這使得許多發展中國家負債累累,外國貸款人可以通過“債轉股”和其他“幫助”它們的安排,輕而易舉地獲得這些國家的資源。

我們可以“以結果論英雄”。國際貨幣基金組織和世界銀行的70餘年來,在100多個發展中國家中,沒有一個國家通過它們的支持從發展中國家行列果斷邁進發達國家行列。這並不奇怪,因為歷史記錄表明,自由貿易和自由市場政策從未使一個國家成為經濟強國。相反,所有的經濟強國都曾實行選擇性貿易和產業保護政策,以發展龐大的本土產業。

國際貨幣基金組織(圖源:Business Standard)

但這不僅僅意味着國際貨幣基金組織和世界銀行的“發展經濟學”失敗了。甚至可以説,這種經濟學是被蓄意設計出來的,目的是阻止經濟發展,使發展中國家處於依賴狀態,使其資源可以被低價攫取。華盛頓式的“發展”打着“比較優勢”的幌子,勸説發展中國家把重點放在低附加值的商品出口上,但由於這些商品的價格相對於高附加值的產品呈長期下降趨勢,因此這些發展中國家會出現國際收支赤字,必須借入外國資金,貨幣也會疲軟,從而導致債務陷阱,同時使其資源對發達國家來説變得越來越便宜。

確實也有國家從發展中國家轉變為發達國家。然而,按人均收入衡量,只有五個國家或地區果斷邁向了發達國家行列,它們是日本、韓國、新加坡和中國及其地區(包括台灣)。然而,這些國家和地區無視華盛頓模式的“發展經濟學”,採取了國際貨幣基金組織和世界銀行明令禁止的政策,如新生產業保護、產業政策、依賴國內銀行信貸創造而非外國貨幣,即中央銀行對高附加值產業的銀行信貸進行“窗口指導”,同時抑制用於消費和資產購買的銀行信貸,從而實現了真正的經濟發展。當然,中國比歷史上任何其他國家擺脱貧困的人數都要多,這要歸功於其違背華盛頓共識“發展經濟學”的政策。

1980年代末,日本政府和許多大藏省官員向國際貨幣基金組織和世界銀行的領導層指出,他們的政策是有缺陷的,應該向高增速的東亞經濟體學習,以瞭解如何快速發展經濟。但是,美國在日本、韓國甚至中國台灣地區都有駐軍,這意味着他們無法挑戰或改變美國主導的國際貨幣基金組織和世界銀行的做法。因此,發展中世界仍然籠罩在旨在阻礙經濟發展的“發展經濟學”的陰雲之下。

接下來,中國在國際貨幣基金組織和世界銀行的正式股東大會以及國際峯會和會議上做出了許多真誠的嘗試,主張應該改變國際貨幣基金組織和世界銀行的政策,其他國家也應該在國際貨幣基金組織和世界銀行中擁有更大的發言權,因為美國的主導地位已經過時,而且也沒有為大多數國家帶來經濟上的成功。但中國試圖改善這一體系的努力遭到了美國的拒絕。

必須指出的是,中國一直堅持自己獨特的發展道路,並不屈從於美國的霸權。中國在上海和北京成立了新開發銀行和亞洲基礎設施投資銀行,並積極參與金磚國家集團。中國還加強了上海合作組織的活動。現在,發展中國家有了不同的選擇,不必再屈從於國際貨幣基金組織和世界銀行的佈雷頓森林體系,接受西方實質上的殖民統治延續。

新開發銀行總部(圖源:Bb3015)

與華盛頓主導的體系不同,中國不干涉發展中國家的政治,也不強加類似國際貨幣基金組織的“條件”,後者的“條件”甚至包括要求修改憲法(如1997年亞洲危機後,國際貨幣基金組織對泰國提出的要求)。相反,在“一帶一路”倡議下,中國將其鉅額外匯儲備投資發展中國家的基礎設施,直接幫助該國發展經濟,並促進雙邊貿易和繁榮。

發展中國家對一個沒有殖民歷史的國家提供的這一替代方案感到感激。接下來,中國需要像鄧小平在國內推動中國經濟迅速崛起那樣,倡導發展中國家建立許多小型地方銀行。這將是替代華盛頓錯誤的“發展經濟學”的最終方案。“發展經濟學”認為銀行並不重要,並迫使各國將重點放在股市發展上,儘管股市事實上並不會帶來經濟增長,反而會助長美國和英國式的賭場資本主義。

中國摒棄了蘇聯時代單一銀行的中央計劃制度,將經濟決策權力下放,由成千上萬家地方小銀行的數十萬名貸款人員負責評估數百萬小企業和微型企業的貸款申請,這讓中國龐大的經濟獲得巨大的收益。這一方針造就了一個強大且龐大的中產階級,意味着不平等現象的下降和國家的繁榮,這要歸功於普通公民強大的購買力。而華盛頓的“發展經濟學”卻使許多非常貧窮的人和一小撮極其富有的精英受益者之間的差距不斷擴大。

“一帶一路”倡議之所以對世界意義重大,還有另一個原因:隨着石油美元體系的崩潰,沙特阿拉伯現在也開始用人民幣出售石油,人們越來越希望擺脱美國霸權和華盛頓式新殖民主義的高壓統治。金磚國家組織和“一帶一路”相輔相成,而通過金磚國家組織,現在有望建立一個替代萎靡不振的石油美元的國際貨幣體系,促進和平貿易與合作,而不需要為之發動石油和能源戰爭。

以下為英語原文:

The Belt and Road Initiative was launched in 2013 by Chinese President Xi Jinping. In 2017, it became enshrined in the constitution of the Chinese Communist Party. This underlined the significance of this program for the People’s Republic. It also makes clear that this is a long-term project. So we know that the Belt and Road Initiative is important for China. But how important is it for the world?

To understand the international significance of the Chinese Belt and Road Initiative, it is necessary to understand what has happened with developing countries in the post-war era, namely under the Bretton Woods system and its Washington-based institutions, the International Monetary Fund and the World Bank.

After the US and UK-led anti-German and anti-Japanese international military alliance of 26 countries, known as “the Allies”, rebranded themselves as “the United Nations” in 1942, the growing number of military allies – largely consisting of the Soviet Union, representatives for China, and Imperial Britain and its colonies, as well as the United States and its colonies – met in a golf club resort for very wealthy guests in Bretton Woods, New Hampshire. There they formalised plans of a new international monetary system for the post-war era, at the centre of which was going to be the US dollar.

The system that was decided upon initially operated by using fixed exchange rates against the US dollar, while the dollar itself could be exchanged into gold at an administered exchange rate. This system was to hold up until 52 years ago, namely until August 1971. After a decade of massive US dollar creation by the US central bank and US banks in the 1960s had angered people in countries whose companies, land and other assets had been bought up by US investors, France had insisted on exchanging many of its resulting dollar reserves into gold. US gold reserves declined. As French Navy ships arrived in Manhattan to carry gold back to France, US president Nixon felt prompted to make his famous announcement on 15 August 1971 that the US would “temporarily” suspend dollar convertibility into gold – a US default on its obligations to the members of the Bretton Woods fixed exchange rate system.

One month before this “Nixon shock”, another important event had happened: With US National Security Council member and former Rockefeller employee Henry Kissinger the first visit to China of a senior member of the US government administration to modern China took place – by the way a trip Henry Kissinger has just repeated, more than half a century later, despite his old age of now 100 years.

At the time of his first visit, the US was suffering from the twin problems of a ballooning trade deficit and a surging government budget deficit. The latter had been caused by the rising spending on military and secret service operations, including the wars and regime change operations in dozens of countries. The former was due to the successful exporting and current account surplus nations Japan and Germany failing to find enough attractive US-made goods they wanted to buy.

When the US rescinded its promise to allow the exchange of US dollars into gold at a set exchange rate, the dollar fell and to maintain military hegemony, US leaders felt this fall had to be stopped. The solution was found in the importing needs of countries like Germany and Japan: most of their energy was imported. The US dollar was thus transformed from the gold-backed dollar into the oil-backed dollar, known as the “petro-dollar”.

US troops were deployed in the largest oil producing country, Saudi Arabia, and a deal was made that its government and royal family would be supported by the US, in exchange for the promise to sell oil only against the US dollar, and invest 80% of the resulting abundance in US dollar reserves in Saudi Arabia back into US Treasuries, thus funding the government budget deficit, and with it, the US foreign wars.

Germany and Japan now needed US dollars, in order to be able to buy the energy needed to operate their economies. Of course, some alternatives were explored, namely Germany gradually began to import gas from the Soviet Union, which always delivered reliably.

The other step to underpin the US dollar was to engineer a massive hike in the oil price, which would essentially transfer vast resources from manufacturing powerhouses Germany and Japan to Saudi Arabia and the United States. For this, Henry Kissinger had to arm-twist the Saudis to quadruple the oil price, which happened in January 1974. To divert the attention from the true sequence and cause of these events, as outlined here, and instead spread the narrative that the driving force of events was the OPEC oil embargo, central banks in the sphere of influence of the Federal Reserve, which included the Bank of England, the Bank of Japan and the Bundesbank, had simultaneously set out in 1971 and 1972 to massively expand the money supply by encouraging a grotesque expansion in bank credit, for property speculation and consumption.

This caused the inflation of the 1970s, despite the dominant official narrative that the inflation was the result of a war and its subsequent energy embargo. (Like Henry Kissinger’s visit to China, also this scenario has recurred half a century later: it was not the Russian military operation to defend the newly formed Republics on Ukraine’s borders that caused the inflation of 2021 and 2022, but the massive expansion in bank credit, coordinated by the Federal Reserve, Bank of England and ECB and implemented in March 2020).

As a result, US economic and political dominance continued in the 1970s. Meanwhile, the Bretton Woods institutions of the IMF and the World Bank had been used to manage what has been billed as a de-colonisation and movement towards independence of many countries and peoples across the globe: The British, US, French, Belgian and Dutch overseas colonial empires faced increasing demands by locals for political independence. Having argued that their fight in the second world war against Germany was for freedom and democracy, it was now difficult for these countries to delay decolonisation for the majority of the population in the world living in developing countries that were under their direct control.

We are told by modern English-language textbooks in “Development Economics” that it was this de-colonialisation that created a new academic discipline taught at their universities, called “Development Economics”. The development economics textbooks point out that this discipline did not exist until the 1950s and 1960s and it was created, because an increasing number of former colonies were becoming independent.

But development economics was not created by the leading thinkers of those newly independent countries! Instead, it was created by British and US economists. This, then, revealed the true purpose of “Development Economics”: Had the task of this English-language discipline by leading economists in the colonial powers been to teach countries and regions how to rapidly develop and move from developing country status to developed country status, it would be as old as colonialism itself: What better time is there for colonial thinkers to shape a country and implement the right policies that will result in rapid economic development, than when the country is under the control of the colonial masters.

However, during centuries of colonial rule, no need was seen for such “Development Economics”. It was only when the colonial masters had to give up their formal political and military control over their colonies that they came up with the idea that these former colonial subjects needed advice on how to develop their economies. Why should the former colonies trust their former colonial masters that had not developed Development Economics during the era of full-blown colonialism? Should they really accept uncritically the books on How to Develop Your Economy handed to them as they said good-bye to their colonial masters and became independent states?

To fend off any potential reluctance by the former colonial subjects to such advice from the sage and well-meaning former colonial rulers, the Washington-based institutions of IMF and World Bank would use the power of money to make the new rules of “Development Economics” more persuasive. The IMF and World Bank famously use “conditionality” when they dispense their loans. Other organisations, including the regional development banks, such as the Interamerican Development Bank, USAID, the OECD and the increasingly influential European Brussels-based bureaucracy, would repeat and re-enforce the Washington Consensus kind of “Development Economics”. These Washington institutions and the many other organisations under the US sphere of influence, which includes much of Europe, preach the insights of the English-language “Development Economics”, namely that countries need to deregulate, liberalise and privatise, as well as open up their markets to foreign competition and allow foreign investment to come in. The key insight they preach is that for economic growth and development, significant financial “savings” are necessary, and if countries have low savings rates, they can borrow “foreign savings” in the form of money lent to them by international banks, such as the IMF and World Bank themselves. This has indebted many developing countries to such proportions that their resources can be easily acquired by the foreign lenders in “debt-for-equity” swaps and other arrangements to “help them”.

We can tell whether a tree is good by looking at its fruits. The bottom line of the 75 years of IMF and World Bank international development policies is that there is not a single country among the more than 100 developing countries that have, thanks to IMF and World Bank-backed policies, moved decisively from developing country status to developed country status. This is not surprising, because the historical record shows that free trade and free market policies have never enabled a country to become an economic power. Instead, all economic powers had previously engaged in selective trade policy and infant industry protection in order to develop a large indigenous industry.

But it’s not just that the IMF and World Bank “Development Economics” failed to deliver. It can even be argued that it was deliberately designed in order to prevent economic development and instead keep developing countries in a state of dependency where their resources could be extracted at low cost. For the Washington-type of “development” consists in persuading developing countries, under the guise of “comparative advantage” to focus on low value-added commodities exports, but because their prices decline over long time periods relative to high value-added finished manufacturing goods, these developing countries will experience balance of payments deficits, feel the need for borrowing foreign money and their currencies weaken, causing debt traps – while making their resources ever cheaper for the rich countries to acquire.

This is not to say that there are no countries that moved from developing country to developed country status. However, there are only five countries or regions that did make a decisive move, measured by per capita income, to developed country status, namely Japan, South Korea, Singapore and China and its regions (including Taiwan). However, they achieved true economic development by ignoring the Washington-style “Development Economics” and adopting policies that are explicitly forbidden by the IMF and the World Bank, such as infant industry protection, industrial policy, and reliance on domestic bank credit creation instead of foreign money, whereby the central banks deployed ‘window guidance’ of bank credit to high value-added industries, while suppressing bank credit for consumption and asset purchases. China of course holds the prize for lifting more people out of poverty than any other country in history, thanks to policies that defied the Washington Consensus-type of “Development Economics”.

In the late 1980s, the Japanese government and many Finance Ministry officials pointed out to the leadership of the IMF and the World Bank that their policies were flawed and instead one should learn from the high growth East Asian economies in order to learn how to develop countries rapidly. But having US troops in Japan, Korea and even the Chinese region of Taiwan meant that voices from these regions could not challenge, let alone, change, the US-dominated IMF and World Bank practice. So the developing world remained under the cloud of “Development Economics” of the type that was designed to prevent economic development.

Next, China made many sincere attempts at formal IMF and World Bank shareholder meetings and at international summits and meetings to argue that IMF and World Bank policies should be changed, and also that other countries should have a bigger voice in the IMF and World Bank, as the US dominance was outdated and also had not resulted in economic success for the majority of countries. But such Chinese attempts to improve the system were rebuffed by the US.

As a consequence the Chinese leadership devised a bold alternative. This is the Belt and Road Initiative launched by President Xi Jinping. China established the New Development Bank and the Asian Infrastructure Investment Bank in Shanghai and Beijing, and became active in the BRICS group of countries. China also stepped up the activities of the Shanghai Cooperation Organisation. Now developing countries have different options and do not need to submit to the de facto continuation of colonial rule via economic policies that the Bretton Woods system of IMF and World Bank had fostered.

Unlike the Washington-led system, China does not interfere in the politics of developing countries and does not impose IMF-style “conditionality” that often goes as far as demanding changes to the constitution (as the IMF demanded from Thailand after the 1997 Asian crisis). Instead, under the Belt and Road Initiative China invests its vast foreign exchange reserves in developing countries in the form of impressive infrastructure investments that directly help develop the receiver countries’ economies and encourage mutual trade and prosperity. Developing countries are grateful for this alternative offered by a country that does not have a history of colonising other countries. What is needed next is for China to champion the establishment of many small local banks in developing countries, just as Deng Xiaoping did at home to launch the rapid rise of the Chinese economy. This would be the ultimate alternative to the Washington-based wrong-headed “Development Economics”, which considers banks unimportant and presses countries to instead focus on stock market development, despite the fact that stock markets do not result in economic growth, but instead fuel US and UK-style casino capitalism.

China’s vast economy has benefitted greatly by abandoning the old Soviet-era mono-bank system of central planning and introducing decentralisation of economic decision-making, delegated to hundreds of thousands of loan officers working for thousands of small local banks evaluating the loan applications of millions of small firms and micro-businesses. This creates a strong and large middle-class, which means inequality declines and the country can prosper, thanks to the strong purchasing power of the average citizen – while the Washington “Development Economics” has presided over an ever-growing disparity between many very poor people and a small elite of extremely rich beneficiaries.

The Belt and Road Initiative is significant for the world for another reason: As the petro-dollar system is crumbling, with Saudi Arabia now selling oil also against the Chinese currency, there is a growing desire to move away from US dominance and the heavy hand of Washington-style neo-colonialism. Through the BRICS initiative, which complements the Belt and Road Initiative, there is now the prospect of an alternative international monetary system that facilitates peaceful trade and cooperation, and does not require oil and energy wars, as is the case with the ailing petro-dollar.

Professor Richard A. Werner, D.Phil. (Oxon), is professor of banking and economics at the University of Winchester. He previously was full professor of economics or finance at Goethe University, Frankfurt, the University of Southampton and Fudan University, Shanghai. His book Princes of the Yen (Quantumpublishers.com) was a number one bestseller in Japan. In 1995, he proposed a new monetary policy for post-crisis countries, which he called “Quantitative Easing”. Based on his Quantity Theory of Disaggregated Credit he warned in 1991 that the Japanese banking system and economy would collapse and move into a great depression. His website is www.professorwerner.org

本文系觀察者網獨家稿件,文章內容純屬作者個人觀點,不代表平台觀點,未經授權,不得轉載,否則將追究法律責任。關注觀察者網微信guanchacn,每日閲讀趣味文章。