【科技】中國車企在歐洲P3的高級駕駛輔助系統基準測試中明顯領先,華為居榜首_風聞

龙腾网-19分钟前

【來源龍騰網】

正文原創翻譯:

中國車企在P3的高級駕駛輔助系統基準測試中明顯領先,華為居榜首。這讓全球車企在中國市場競爭變得十分困難。(譯註:P3是德國知名諮詢管理公司)

P3 ADAS Benchmark – China Edition: Huawei’s system takes the lead

P3 高級駕駛輔助系統基準測試(中國版):華為的系統領跑

Cars are becoming computers on wheels. This development is particularly evident in China and is underlined by a recent study by management consultancy P3, which analysed the performance of advanced driver assistance systems (ADAS) from various manufacturers.

汽車正在變成四個輪子上的電腦,這一發展趨勢在中國尤為明顯。德國知名管理諮詢公司P3最近的一項研究分析了各家廠商的高級駕駛輔助系統(ADAS)性能,更加印證了這一點。

原創翻譯:龍騰網 https://www.ltaaa.cn 轉載請註明出處

P3 organised its two-day ‘Car Experience Event’ as part of the Beijing Auto Show this year. Almost 70 customers accepted the invitation. A total of eight vehicles were available for test drives. Nearly all test cars had a Level 2++ feature, specifically the ‘Navigation on Pilot’ (NoP) function in the city (exceptions: Baojun Yunduo with L2+ and BYD Song L with L2).

今年,P3在北京車展期間組織了為期兩天的“汽車體驗活動”。近70位客户應邀參加。現場提供了8台測試車輛。除了寶駿雲朵(L2+)和比亞迪宋L(L2)外,幾乎所有測試車都擁有了L2++級功能,特別是城市環境下的“領航輔助駕駛”功能。

To clarify: Level 2+/2++ goes beyond the usual Level 2 systems by enabling advanced assistance functions such as hands-free driving under certain conditions – for example, in clearly defined areas such as motorways (L2+) or the city (L2++). The regulations in China do not actually allow hands-free driving. However, Chinese manufacturers rely on comparatively generous time windows in which the driver is asked to take over the steering wheel. It gives the impression that the vehicle can drive autonomously for several minutes. However, as with all L2, L2+ and L2++ systems, the responsibility remains entirely with the driver.

需要説明的是:L2+/L2++超越了普通的L2級系統,在特定條件下可以實現更高級的輔助功能,比如不用將手放在方向盤上。這些條件包括高速公路(L2+)或城市道路(L2++)等明確界定的區域。雖然中國法規實際上不允許這種完全不觸摸方向盤的駕駛,但中國廠商採用了相對寬鬆的接管提醒時間。這給人一種車輛可以自動駕駛幾分鐘的印象。不過,和所有L2、L2+及L2++級別的系統一樣,駕駛責任完全在駕駛員。

The P3 ADAS Index

P3 高級駕駛輔助系統指數。

The uation and comparison of ADAS is a major challenge in the automotive industry. Despite the increasing prence and importance of ADAS functions, there is a lack of clearly defined KPIs and standardised uation methods. This gap leads to uncertainty among consumers, manufacturers and regulators, who find it difficult to assess the performance and benefits of ADAS. P3 has developed the ADAS Index to solve precisely this problem. Using a standardised frxwork and over 100 specific test cases, the P3 ADAS Index provides an obxtive and traceable assessment of ADAS performance across all function clusters (driving, parking and safety) up to and including SAE Level 3.

評估和對比高級駕駛輔助系統是汽車行業的一大挑戰。儘管ADAS功能越來越普及且重要性與日俱增,但行業缺乏明確的關鍵性能指標和標準化評估方法。這導致消費者、廠商和監管機構在評估ADAS性能和價值時感到困惑。為解決這個問題,P3開發了高級駕駛輔助系統指數。該指數採用標準化框架和100多個具體測試案例,對包括L3級在內的所有功能集羣(駕駛、泊車和安全)進行客觀、可追溯的評估。

It takes into account the categories of performance, comfort, safety, usability and perception to provide a comprehensive and meaningful overall picture. P3 has set itself the goal of creating transparency and comparability in this complex field to promote the development of safe and efficient driver assistance systems. The P3 ADAS Index helps both industry and consumers make informed decisions while supporting the advancement of these critical technologies.

該指數綜合考慮了性能、舒適度、安全性、易用性和感知等方面,提供全面而有意義的整體評價。P3的目標是在這個複雜領域創造透明度和可比性,推動安全高效的駕駛輔助系統發展。P3 ADAS指數幫助業界和消費者做出明智決策,同時支持這些關鍵技術的進步。

How well and how reliably do the systems work?

這些系統的效果和可靠性如何?

The vehicles could carry out complex manoeuvres, from automated left and right turns to lane changes – even in very dense traffic scenarios. The ADAS systems of all the test cars were ultimately convincing in both the city and on the motorway. Tests were conducted in the driving, parking and on-board safety function clusters.

這些車輛能夠執行復雜的操作,從自動左轉右轉到變道,即使在車流密集的情況下也能應付自如。所有測試車的ADAS系統最終在城市和高速公路場景下都表現出色。測試涵蓋了駕駛、泊車和車載安全功能集羣。

原創翻譯:龍騰網 https://www.ltaaa.cn 轉載請註明出處

Incidentally, Chinese OEMs achieve a high level of confidence in the systems here, as they show a detailed display of the surrounding situation in the HMI displays and provide constant audio feedback on intended and upcoming manoeuvres.

值得一提的是,中國車企在這方面獲得了很高的用户信任度,因為他們在人機界面顯示屏上詳細展示周邊環境狀況,並持續提供語音反饋,提示預計和即將進行的操作。

Winners and losers in the P3 ADAS Index

P3 的ADAS指數中孰強孰弱

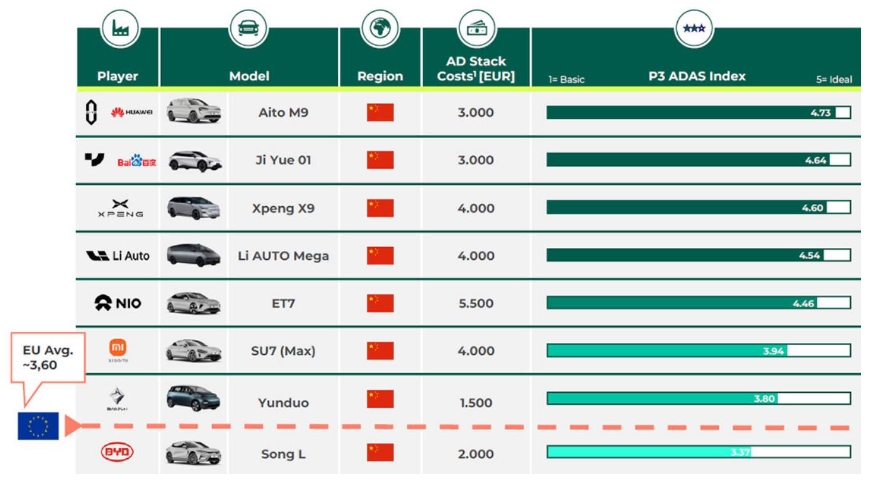

The scale of the P3 ADAS Index ranges from 1 (basic) to 5 (ideal) – with the European average being 3.6. The Aito M9, which uses Huawei technology, secured the top spot in the index with a 4.73. The Ji Yue 01 (4.64) and the Xpeng X9 (4.60) follow in second and third place. Only the BYD Song L with its L2 came in at 3.37 – below the European average.

P3 ADAS指數的評分範圍是1(基礎)到5(理想),歐洲平均水平為3.6。採用華為技術的問界M9以4.73分位居榜首。極越01(4.64分)和小鵬X9(4.60分)分別排名第二和第三。只有搭載L2系統的比亞迪宋L得分3.37,低於歐洲平均水平。

In an international comparison, Chinese OEMs clearly lead the P3 ADAS Benchmark. That makes it very difficult for global OEMs to compete in the Chinese market. In addition, international manufacturers are not expected to launch Level 2+ functions on the Chinese market before the end of 2025.

在全球比較中,中國車企在P3 ADAS基準測試中明顯領先。這讓全球車企在中國市場競爭變得十分困難。此外,預計國際廠商在2025年底前都無法在中國市場推出L2+功能。

The results of the P3 ADAS Index are, of course, a snapshot in time – the driving functions are constantly evolving thanks to regular software upxes. In the test, for example, the Aito M9 was travelling with ADS 2.0. It has now launched ADS 3.0. Nevertheless, there are signs of a fundamental trend in the performance of Chinese players. With this in mind, P3 plans to carry out such tests regularly and monitor technical developments.

P3 ADAS指數的結果當然只是一個時間點的快照,駕駛功能在更新下不斷進化。比如測試時問界M9使用的是ADS 2.0,現在已經升級到ADS 3.0。儘管如此,中國玩家的表現還是顯示出一個基本趨勢。有鑑於此,P3計劃定期進行這類測試,持續關注技術發展。

Market outlook

市場展望。

原創翻譯:龍騰網 https://www.ltaaa.cn 轉載請註明出處

In the increasingly competitive environment with regard to ADAS and charging performance, Chinese OEMs are likely to secure further market share in the domestic NEV market. And, of course, Chinese manufacturers are also looking to Europe – where, in addition to special tariffs, further regulatory hurdles concerning cyber security and functional safety await.

在ADAS和充電性能競爭日益激烈的環境下,中國車企很可能在國內新能源汽車市場獲得更多份額。當然,中國廠商也在覬覦歐洲市場,但在那裏,除了特殊關税外,還面臨着網絡安全和功能安全方面的監管障礙。

Established Chinese technology companies such as Huawei and Baidu are driving progress in ADAS performance and cooperation with international OEMs (Baidu & Tesla, VW & Xpeng). As a result, EU Tier 1 suppliers such as Bosch are losing ground.

華為和百度等老牌中國科技公司正在推動ADAS性能進步,並與國際車企展開合作(百度與特斯拉、大眾與小鵬)。結果,博世等歐洲一級供應商正在失去優勢。

“Overall, European car manufacturers are currently at least two years behind their Chinese competitors in terms of development,” summarises Marco Dargel, Partner at P3.“It makes the race for leadership in the all-important driver assistance systems and software in China challenging for German and international OEMs and established suppliers.”

P3合夥人Marco Dargel總結説:“總的來説,歐洲汽車製造商目前在開發方面至少落後中國競爭對手兩年。這讓德國和國際車企以及老牌供應商在中國市場爭奪至關重要的駕駛輔助系統和軟件領導地位時變得更加困難。”。

Chinese technology companies and startups such as Horizon Robotics, Black Sesame, Phigent Robotics and Robosense are not standing still either.

地平線、黑芝麻智能、鑑智機器人和速騰聚創等中國科技公司和初創企業也在持續發力。

原創翻譯:龍騰網 https://www.ltaaa.cn 轉載請註明出處

With important new products and technologies (lidar, low-cost camera solutions, SoC), they will likely become increasingly valuable partners for OEMs, enabling them to improve their product range. “China must now be seen as a lead market to increase the speed of development through targeted cooperation,” concludes Dargel.

憑藉重要的新產品和技術(激光雷達、低成本攝像頭解決方案、車機系統),它們很可能成為車企越來越有價值的合作伙伴,幫助車企改善產品陣容。Dargel總結説:“現在必須把中國視為領先的市場,通過有針對性的合作來加快開發速度。”。